Gift Card Scams

Gift card fraud is a rising issue for people everywhere. Scammers use tricks like phishing and draining to take advantage of weaknesses in gift card…

Read More

Is a Credit Union Membership for Me?

Managing your money and finding reliable options for financial institutions can often feel overwhelming, especially if you’ve never been to a bank or credit union.…

Read More

Estate Planning

It's easy to put off estate planning and consider it a task for later in life. You might be intimidated by the thought of getting…

Read More

Protection From Card Skimming

People use their debit cards for everything from buying groceries to getting gas. The convenience of having debit/credit cards eliminates most needs for cash. But…

Read More

Finding Home Empowers Families on Their Journey Towards Homeownership

Finding HOME is a comprehensive 12-18 month program that offers free financial education, behavior counseling, and housing support to empower families on their journey towards…

Read More

Welcome to the Future of Banking: Features and Benefits of Smart ATMs

Maybe you can picture yourself in this scenario: you wake up with a long list of errands, one being a trip to your credit union…

Read More

10 Steps for First-time Homebuyers: The Home Buying Process

Buying a home is a big milestone in many people’s lives. But especially for first-time homebuyers, understanding how to buy a house can be overwhelming…

Read More

13 Holiday Tips for Total Well-Being

The holiday season, often seen as the most wonderful time of the year, can also bring a significant amount of stress and anxiety for many…

Read More

Finally, a Checking Account That Gets It.

Imagine a checking account that’s easy, and convenient. It has features that help you better manage your money, it helps you out when you’re in…

Read More

Overcoming Homelessness: Your Path to a Brighter Financial Future

Individuals and families who have found themselves homeless face a challenging journey back to stability. It's not easy to figure out how to get out…

Read More

Student Loan Repayment, Simplified

After a historical hiatus throughout the pandemic, borrowers now face federal student loan repayment. Evaluating your full financial picture and making a repayment plan goes…

Read More

MCU Foundation Annual Golf Outing Raises More than $150,000

Marine Credit Union works hard to help members with their financial needs, but some needs can’t be met with loans or savings accounts. We started…

Read More

Facing Homelessness: What to Expect and How to Prepare

Many individuals and families who have experienced homelessness have gone on to lead fulfilling lives. Preparing for homelessness and regaining housing stability and financial security…

Read More

How to Report Identity Theft

Our digital lives make things easier, but they also provide opportunities for identity thieves. Thieves can commit fraud using our names, Social Security numbers, credit…

Read More

Medical Debt

Medical debt is a concerning financial situation faced by many individuals and families. Unexpected medical expenses can lead to substantial financial strain, impacting credit scores…

Read More

Financial Stress and Your Mental Health

In today's fast-paced world, managing our finances effectively is a daunting task. Maintaining our finances is actually crucial for our overall well-being. Financial wellness and…

Read More

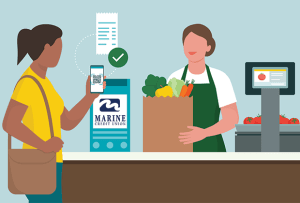

What is a Digital Wallet?

In today's fast-paced digital world, carrying around a physical wallet filled with multiple cards seems outdated. Although most people still use physical cards and wallets,…

Read More

How Does Refinancing Work?

Refinancing is the process of replacing an existing loan with a new loan that has different terms, often with the goal of obtaining a lower…

Read More

How to Use a HELOC Loan the Right Way

If you're a homeowner, you can be proud of the equity you've built in your home. You've worked hard to manage your mortgage and make…

Read More

Car Buying Made Simple

Buying a car can be a daunting task, especially if you are a first-time buyer. With so many options available in the market, it can…

Read More

Taxpayers Beware: Five Common Scams to Avoid During Tax Season

At this time of year, criminals love to impersonate IRS agents. Scammers use the anxiety many of us feel surrounding our taxes to trick us…

Read More

Understanding Overdraft Protection: Minimize Fees, Maximize Savings

Sometimes, despite your best efforts (or intentions!) to stick to a budget, you might find your checking account a little short. Maybe you ran into…

Read More

Is it Cheaper to Build or Buy a House?

Whether you're a first-time homebuyer or a current homeowner dreaming of a new abode, you may have visions of owning wide open space full of…

Read More

Tips for Safe Holiday Shopping

The holiday season is upon us, and that means it's time to get your shopping on. While we all love getting great deals on Black…

Read More

Checking Accounts That Work For You

When it comes to managing your money, there are a lot of different products, services, and support you can use. And while everyone's goals are…

Read More

The Basics of Buying Land: 6 Steps to Ownership

A lot of people dream of staking claim to their own piece of land. The open space comes with all sorts of possibility, giving you…

Read More

Compassionate Lending & Collecting

Getting a loan. For many, the thought conjures up conflicting feelings. On the one hand, it elicits hope and excitement at the prospect of fulfilling…

Read More

5 Tips For Back-to-School Shopping

It is that time of year again for kids to get ready to go back-to-school! With inflation continually rising, prices on all kinds of items…

Read More

Spotting fraudsters, scammers, and identity thieves online

Consider this: In 2021, the Federal Trade Commission (FTC) received 2.8 million fraud reports from consumers. Of the losses those consumers reported, more than $2.3…

Read More

Vacation Budgeting 101

You booked your flight, you booked your stay and you gathered a list of attractions you may want to see on your vacation… but what…

Read More

Financial Fitness

Spring always brings a new wave of motivation! The great hibernation is almost over as people become more active. Maybe winter derailed your New Year’s…

Read More

15 Date Ideas on a Budget

Seeing hearts? Valentine’s day sets the tone for February being one of the most romantic days/months of the year. Many people feel the need to…

Read More

New Year, Fresh Start! Invest in Yourself & Your Future

Ringing in the New Year is often accompanied by new year resolutions, goal resets, and how to be your best self compared to the previous…

Read More

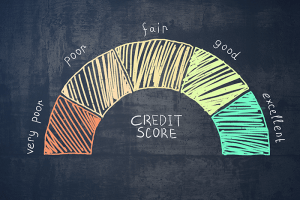

How to Understand Your Credit Score

If you were to google any topic about “understanding credit” right now, you would be directed to over 9 billion hits in total. That is…

Read More

Boost Your Property Value with These Remodeling Projects

Boosting Your Property Value The housing market is hot right now, and many people realize now is the time to get as much for your…

Read More

Reach for the Stars: How to Achieve Financial Wellness Post-Pandemic

It is easy to get bogged down in the day-to-day grind. And it is hard to think about the future when you are feeling uncertain…

Read More

Distrust in Financial Institutions

When it comes to putting trust in banks/credit unions with your money or financial plans, there may be a lot of hesitation– Who do I…

Read More

Quick Daily Tips to Prevent Identity Theft from Happening to You

This is real, people. But Marine has your back! Let us tell you a story. It was a Tuesday. A Marine Credit Union lender was…

Read More

Take Control of Managing Your Budget: The Road to Financial Independence

The road to financial independence can be intimidating, but not if you know where to start. Saving money can often be a challenge. We’re wired to take…

Read More

Plan Ahead for Your Family Vacation

You and your family are counting down the days to vacation. The excitement’s building, especially since you plan to travel with a new (or new-to-you)…

Read More

Tips and Strategies to Pay Off Your Debt

By Ken Brossman, Senior Vice President and Regional Manager – La Crosse, Marine Credit Union Credit cards, car loans, recreational vehicle loans, mortgage loans, school…

Read More

Why Choose a Credit Union

Selecting a financial institution can be confusing. Credit union or bank? Better interest rates or more flexibility? These questions can create even more questions. That’s…

Read More

4 Steps to Buying Your Dream Home

Subject Matter Expert: Jason Kaufman – Milwaukee District Manager Many people dream of buying a home, but not everyone knows how to make it reality.…

Read More

Celebrating the Inspirational Women of Marine Credit Union

Inspirational and impactful women improve the world every day at Marine Credit Union. Collections Manager, Hannah Dickinson, brought forth the idea to celebrate International Women’s…

Read More

3 Important Questions to Answer Before You Buy a House

By Josh Moore, District Manager – Northwest District, Marine Credit UnionMarch 6, 2021 | 1 Min. Read Down payment: How much do I have saved…

Read More

Make Your Checking Account Work for You

A checking account is a checking account, right? WRONG! Checking accounts have become a “staple” of banking, but you have more options than ever before.…

Read More

Financial Literacy Counseling: A Calling for Majel Hein

Majel Hein was the first Financial Literacy Counselor to come on board at the Marine Credit Union Foundation to create and manage our Finding HOME…

Read More

Jon’s Journey to Financial Stability

After driving by Marine Credit Union’s branch in Racine, WI, Jon Eckblad became curious about the credit union and how Marine might be able to…

Read More

Buying a Home Is Easy as 1, 2, 3… 4, 5, 6!

The homebuying process can be overwhelming. But it doesn’t have to be! Especially if you know where to start and what to expect. Follow these…

Read More

Consider the Length of Your Auto Loan

By Jason Kaufman, District Manager – Milwaukee, Marine Credit Union When it comes to auto loans, the shorter the term, the better. That may be…

Read More

Make Your Tax Return Work For You

In just a few weeks (or less), many Americans will be receiving a tax refund. The average tax refund received in 2020 was just shy…

Read More

Take Some Stress Out Of Managing Your Money

Financial challenges have been at the forefront of many households across the country, especially with the rise of COVID-19. One thing we know is that…

Read More

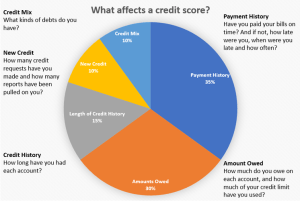

Credit 101 – How Does Credit Work?

Confused by your credit report? Review the five areas below that affect your credit report/score and the tips to bring your score up.

Read More

Tips for Saving Money

By Jeff Lachman, Branch Manager, Onalaska Whether you are living paycheck to paycheck or have some extra cash every month, it’s important to save for…

Read More

Protect Yourself Against Identity Theft or Fraud

By Marie MacGlashin, Director of Deposit Operations, Marine Credit Union Now more than ever it is important to be on the look out for scams…

Read More

Use Your Home Equity To Your Advantage

While some of us have put a spending freeze on our personal budgets, others are interested in making some home improvements or going back to…

Read More

The FAQs of Certificates

What is a Certificate? A Certificates (banks call them Certificates of Deposit, or CDs) is a savings vehicle used to earn a higher rate of…

Read More

9 Ways to Cut Your Spending in College

Heading off to college is exciting! Maybe you’re in a new town, have new friends and trying new experiences all at the same time. But…

Read More

Navigating Financial Uncertainty

Here at Marine Credit Union we know times might be hard right now but we’re here to help! Download our free guide to Navigating Financial…

Read More

4 Ways to Make Home Improvements Fit in Your Budget

Plans cancelled this summer? Working on some home improvement projects? Want to keep things under budget while your income has slowed? Where do you start?…

Read More

Be Smart When Online Shopping

Technology has made shopping easier and quicker than ever before, especially now with more people staying home. Be smart while online shopping and keep these…

Read More

A Mission Statement that Sparked a Movement

The mission was already there – it needed to be carved away like a sculptor removing the excess material that distracted what was underneath all…

Read More

Blessed By The Gift of Adoption

Years ago, after Bill and Cathy were married, they felt passionate about growing their family, not only biologically but also to provide a forever family…

Read More

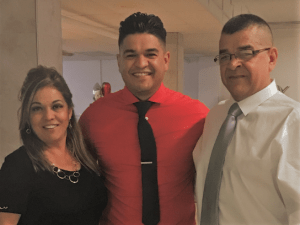

Dignity, Respect for All a Family Legacy for Mo Contreras, MCU’s Bilingual Mortgage Rep

Meet Mo. Mo works on the Marine team as a bilingual mortgage representative. He is an ITIN Certified Lender, which means he is uniquely qualified…

Read More

NOW Is The Time: Plan Ahead for Next Holiday Season

By Jason Kaufman, District Manager, Marine Credit Union Why wait to start planning ahead for those inevitable financial burdens that seem to come up every…

Read More