THE FINDING HOME PROGRAM EMPOWERS FAMILIES

By Chandler Sullivan

January 25, 2024 | 4 Min. Read

By Chandler Sullivan

January 25, 2024 | 4 Min. Read

Finding HOME is a comprehensive 12-18 month program that offers free financial education, behavior counseling, and housing support to empower families on their journey towards homeownership. This program is geared towards families that are financially vulnerable or historically marginalized populations.

Participants in the program have the opportunity to meet with a financial coach three times per month, attend educational courses, and receive guidance in navigating available resources. By actively engaging in the program, families can build strong savings, reduce debt, and significantly improve their credit scores.

Upon completion of the program, families are guaranteed access to a mortgage that aligns with their financial goals and aspirations.

Homeownership is a fundamental pillar in helping families achieve financial stability. Extensive research and surveys consistently show that owning a home improves the quality of life in several measurable ways. These include fostering feelings of stability and pride, promoting community involvement, reducing healthcare visits, and enhancing academic performance.

The program is designed to be inclusive, with no income restrictions for participants. This is crucial because many families often fall through the cracks when strict income guidelines are in place.

For instance, if a family’s income exceeds the HUD guideline by just $10, they become ineligible for certain programs. Finding HOME fills this gap in homeownership programming and provides support to families who have been left behind. These families find themselves trapped in a cycle of financial instability due to various factors both in and out of the families control. They are burdened by debt acquired to fulfill immediate desires without considering the long-term consequences.

Finding HOME empowers participants to adopt a proactive approach to managing money, helping them understand how today’s $90 spent at a restaurant like Olive Garden can impact their ability to pay their cell phone bill four weeks from now.

The Finding HOME initiative is proudly breaking the cycle of generational financial instability by facilitating homeownership opportunities for (previously mentioned) ALICE and BIPOC populations.

Our primary recruitment method involves collaborating with referral partners and conducting community presentations. We receive support from local nonprofit organizations such as Head Start, Habitat for Humanity, New Horizons, Great Rivers United Way, Hope Restores, and BLACK.

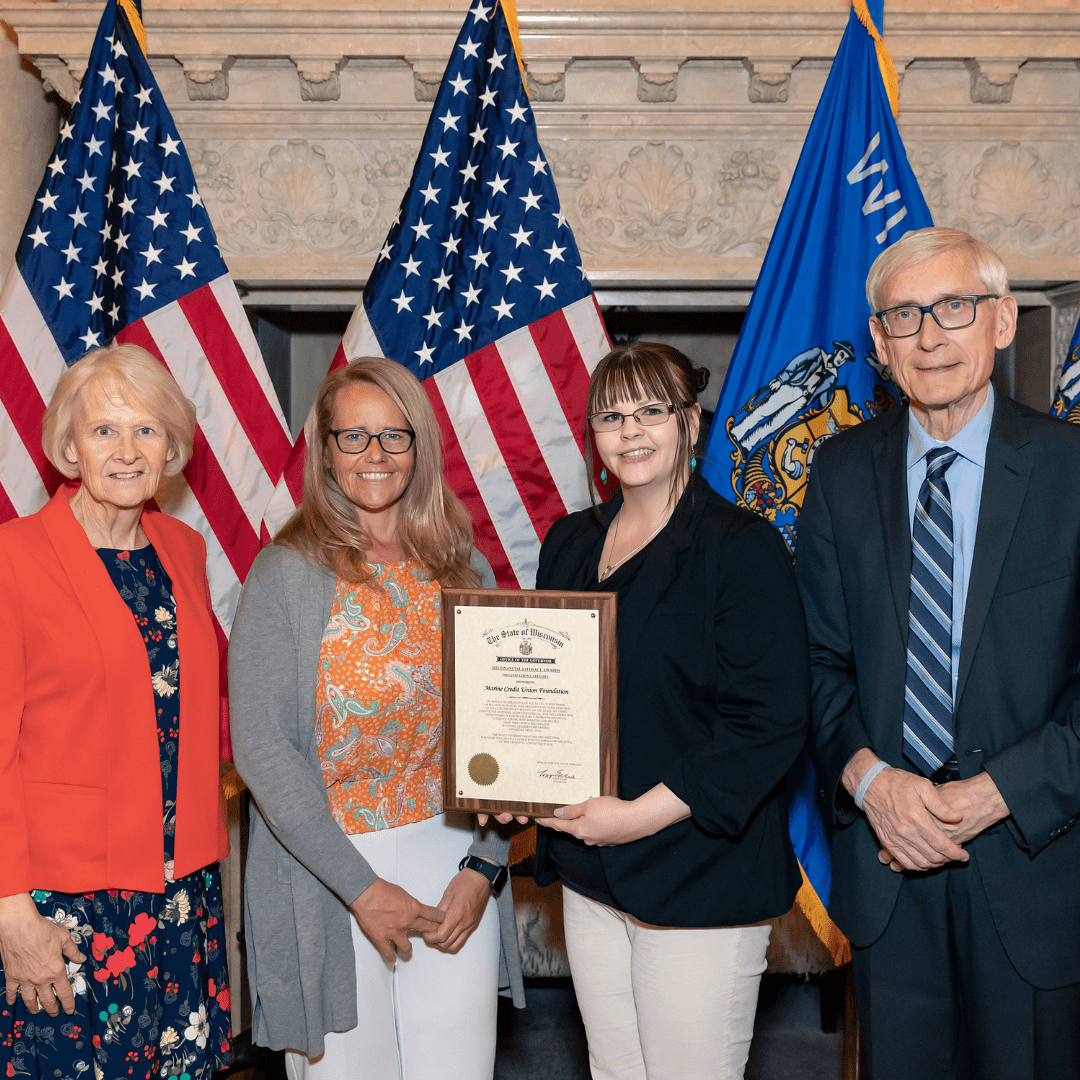

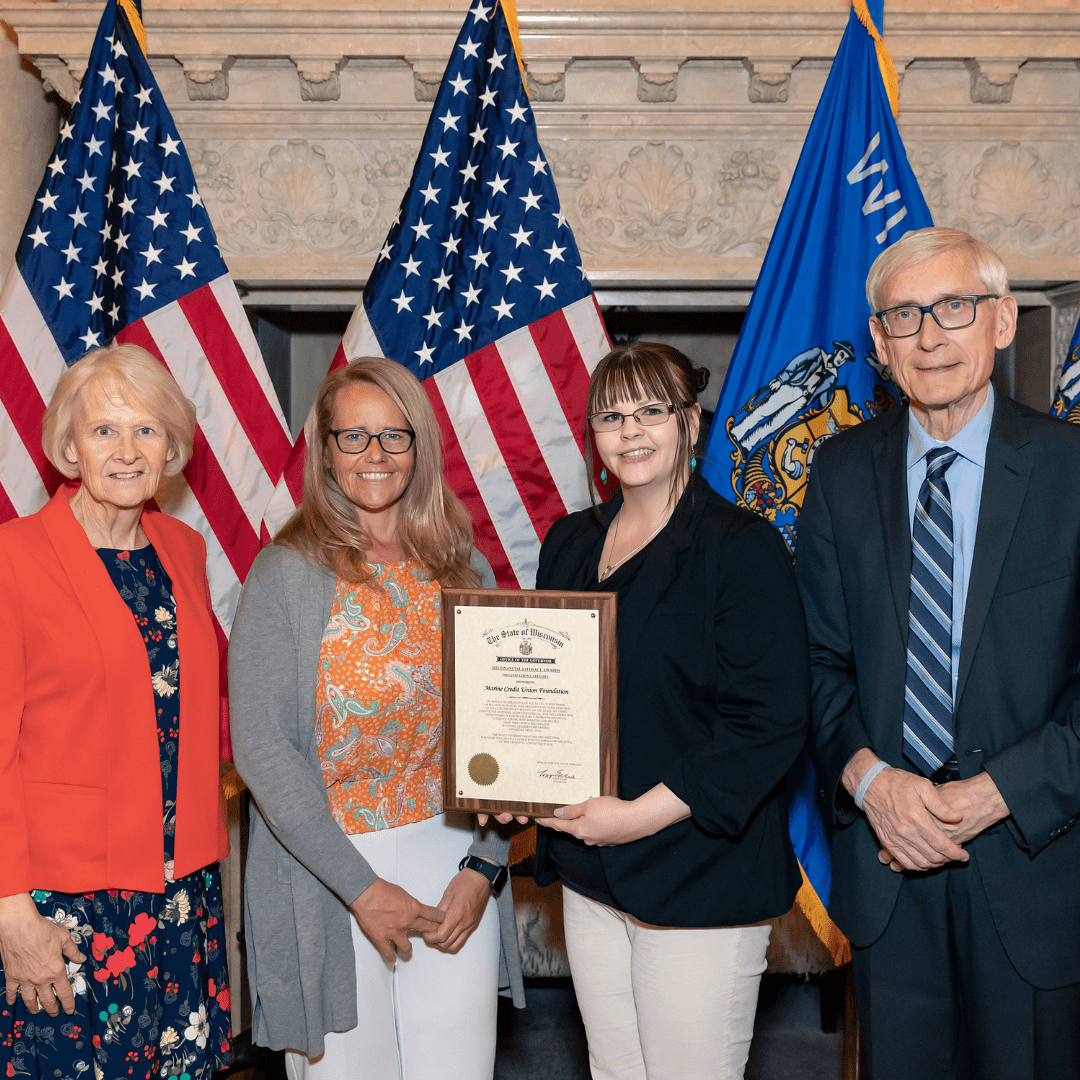

Majel Hein, the Director of Financial Education at Finding HOME, has been recognized with Governor Evers’ Financial Literacy Legacy Award. Majel and her team have established strong connections within their communities and have worked diligently to build trust, especially among populations of color. This effort has proven to be effective, as it has led to an increased success rate in our programs. As a result of our outreach initiatives, individuals schedule appointments with Majel to receive guidance on their journey toward homeownership.

After participants are referred or mention interest in the program, the Financial Literacy Counselor (FLC) calls to set up a housing review appointment, where participants work through monthly expenses, debt-to-income ratios, and develop a path to homeownership.

Many times, participants already qualify for a loan product that they are unaware of. If they do not, however, they are offered placement in Finding HOME or given a plan to enter Finding HOME. Indeed, the first graduates of the program were told that homeownership could be attained if full-time employment at $13/hour was gained by one of the household members; three weeks later, they obtained adequate employment and were entered into the program. People sometimes don’t know what they don’t know.

Program participants are required to have three interactions with the FLC every month, including at least one face-to-face session (virtual face-to-face meetings are also acceptable). In the initial one-on-one counseling sessions, we focus on analyzing your financial situation, creating a budget, and evaluating your knowledge, skills, and confidence levels. We will work together to develop a comprehensive and personalized plan to help you become ready for a mortgage by the end of the program.

During the final months, we will actively prepare you for homeownership by helping you save for monthly mortgage payments, engaging in activities related to buying a home, providing homeowner education, and guiding you through the process of purchasing a home that meets your needs. Upon successful completion of the program, you will have guaranteed access to a mortgage that fits your spending plan.

Participants attend three financial education classes per year:

After participants move into their homes, they will receive monthly check-ins from the FLC for the first six months. After six months, the frequency of check-ins will be reduced to quarterly for the rest of the year. In the second and third years, check-ins from the FLC will occur twice a year, unless there are issues like late payments or other problems.

Each program participant has the opportunity to meet with a Financial Trauma Coach (FTC) at least once, with the option to have multiple sessions as needed. The inclusion of this role aims to support participants in completing the program, especially those who may face significant challenges along the way.

As participants begin to address their financial situation, it is common for previously avoided or present issues to emerge, potentially hindering their progress. The FTC is there to assist participants in developing skills to combat these challenges, which can include relationship issues, trauma, mental health concerns, and readiness for change.

This valuable support is designed to help participants continue making financial progress while overcoming potential barriers that might have otherwise led them to discontinue their participation in the program.

Does Finding HOME sound like a good fit for you? Find out more online or contact us today!