THE IMPORTANCE OF CHECKING YOUR CREDIT REPORT

Maintaining your credit requires regular monitoring and proactive management. In this blog, you'll meet two friends, Oliver and Jesse, who take different approaches to managing…

Read More

ELDER FRAUD

Every year, countless elderly Americans become victims of various financial scams including but not limited to romance, lottery, and sweepstakes scams. Scammers establish trust with…

Read More

WHAT IS A SHARE CERTIFICATE?

When it comes to saving money, everyone wants to find the best way to maximize their earnings while ensuring their funds remain secure. One attractive…

Read More

LEARN HOW TO USE A PASSWORD MANAGER

Imagine this: you receive an alert from your credit union about a failed online banking login attempt. Alarmed, you contact them and learn that someone…

Read More

MY PRIZE CHECKING REWARDS YOU FOR EVERYDAY SPENDING

Imagine a world where banking is magic. You rub the lamp of financial opportunity, and with each stroke, you unlock rewards beyond your wildest imagination.…

Read More

ADJUSTABLE RATE MORTGAGES VS. FIXED RATE MORTGAGES: WHAT YOU NEED TO KNOW

In the world of mortgages, there are two primary options that borrowers often consider: adjustable-rate mortgages (ARMs) and fixed-rate mortgages (FRMs). If you're in the…

Read More

HOW TO TALK TO CREDITORS AND DEBT COLLECTORS

It's happened to all of us: the due date on a bill creeps up and the balance in our checking account doesn't quite cover the…

Read More

GIFT CARD SCAMS

Gift card fraud is a rising issue for people everywhere. Scammers use tricks like phishing and draining to take advantage of weaknesses in gift card…

Read More

IS A CREDIT UNION MEMBERSHIP FOR ME?

Managing your money and finding reliable options for financial institutions can often feel overwhelming, especially if you’ve never been to a bank or credit union.…

Read More

ESTATE PLANNING

It's easy to put off estate planning and consider it a task for later in life. You might be intimidated by the thought of getting…

Read More

PROTECTION FROM CARD SKIMMING

People use their debit cards for everything from buying groceries to getting gas. The convenience of having debit/credit cards eliminates most needs for cash. But…

Read More

THE FINDING HOME PROGRAM EMPOWERS FAMILIES

Finding HOME is a comprehensive 12-18 month program that offers free financial education, behavior counseling, and housing support to empower families on their journey towards…

Read More

WELCOME TO THE FUTURE OF BANKING: FEATURES AND BENEFITS OF SMART ATMS

Maybe you can picture yourself in this scenario: you wake up with a long list of errands, one being a trip to your credit union…

Read More

10 STEPS FOR FIRST-TIME HOMEBUYERS: THE HOME BUYING PROCESS

Buying a home is a big milestone in many people’s lives. But especially for first-time homebuyers, understanding how to buy a house can be overwhelming…

Read More

13 HOLIDAY TIPS FOR TOTAL WELL-BEING

The holiday season, often seen as the most wonderful time of the year, can also bring a significant amount of stress and anxiety for many…

Read More

CHOOSING A CHECKING ACCOUNT THAT GETS IT

Imagine a checking account that’s easy, and convenient. It has features that help you better manage your money, it helps you out when you’re in…

Read More

OVERCOMING HOMELESSNESS: YOUR PATH TO A BRIGHTER FINANCIAL FUTURE

Individuals and families who have found themselves homeless face a challenging journey back to stability. It's not easy to figure out how to get out…

Read More

STUDENT LOAN REPAYMENT SIMPLIFIED

After a historical hiatus throughout the pandemic, borrowers now face federal student loan repayment. Evaluating your full financial picture and making a repayment plan goes…

Read More

FACING HOMELESSNESS: WHAT TO EXPECT AND HOW TO PREPARE

Many individuals and families who have experienced homelessness have gone on to lead fulfilling lives. Preparing for homelessness and regaining housing stability and financial security…

Read More

MEDICAL DEBT

Medical debt is a concerning financial situation faced by many individuals and families. Unexpected medical expenses can lead to substantial financial strain, impacting credit scores…

Read More

FINANCIAL STRESS AND YOUR MENTAL HEALTH

In today's fast-paced world, managing our finances effectively is a daunting task. Maintaining our finances is actually crucial for our overall well-being. Financial wellness and…

Read More

WHAT IS A DIGITAL WALLET?

In today's fast-paced digital world, carrying around a physical wallet filled with multiple cards seems outdated. Although most people still use physical cards and wallets,…

Read More

HOW DOES REFINANCING WORK?

Refinancing is the process of replacing an existing loan with a new loan that has different terms, often with the goal of obtaining a lower…

Read More

HOW TO USE A HELOC LOAN THE RIGHT WAY

If you're a homeowner, you can be proud of the equity you've built in your home. You've worked hard to manage your mortgage and make…

Read More

UNDERSTANDING OVERDRAFT PROTECTION: MINIMIZE FEES, MAXIMIZE SAVINGS

Sometimes, despite your best efforts (or intentions!) to stick to a budget, you might find your checking account a little short. Maybe you ran into…

Read More

CHECKING ACCOUNTS THAT WORK FOR YOU

When it comes to managing your money, there are a lot of different products, services, and support you can use. And while everyone's goals are…

Read More

COMPASSIONATE LENDING & COLLECTING

Getting a loan. For many, the thought conjures up conflicting feelings. On the one hand, it elicits hope and excitement at the prospect of fulfilling…

Read More

FINANCIAL FITNESS AND INSURANCE

Spring always brings a new wave of motivation! The great hibernation is almost over as people become more active. Maybe winter derailed your New Year’s…

Read More

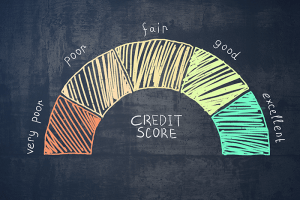

HOW TO UNDERSTAND YOUR CREDIT SCORE

Credit is one of the most important topics related to finances that will consistently affect a person’s financial situation. It is crucial to know what…

Read More

REACH FOR THE STARS: HOW TO ACHIEVE FINANCIAL WELLNESS POST-PANDEMIC

The pandemic has affected many businesses’ and individuals’ finances, leading to significant losses as opportunities became scarce. In fact, 44% of people whose financial situations got…

Read More

DISTRUST IN FINANCIAL INSTITUTIONS

hen it comes to putting trust in banks/credit unions with your money or financial plans, there may be a lot of hesitation-- Who do I…

Read More

TAKE CONTROL OF MANAGING YOUR BUDGET

Saving money can often be a challenge. We’re wired to take care of our needs now, and worry about later… well, later. However, saving money…

Read More

FINANCIAL LITERACY COUNSELING: A CALLING FOR MAJEL HEIN

Majel Hein was the first Financial Literacy Counselor to come on board at the Marine Credit Union Foundation to create and manage our Finding HOME…

Read More

MAKE YOUR TAX RETURN WORK FOR YOU

In just a few weeks (or less), many Americans will be receiving a tax refund. The average tax refund received in 2020 was just shy…

Read More

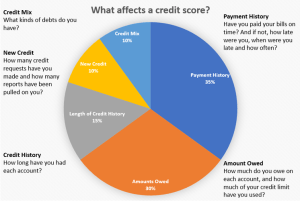

CREDIT 101 – HOW DOES CREDIT WORK?

Confused by your credit report? Review the five areas below that affect your credit report/score and the tips to bring your score up.

Read More

THE FAQS OF CERTIFICATES

What is a Certificate? A Certificates (banks call them Certificates of Deposit, or CDs) is a savings vehicle used to earn a higher rate of…

Read More