IS IT CHEAPER TO BUILD OR BUY A HOUSE?

Whether you're a first-time homebuyer or a current homeowner dreaming of a new abode, you may have visions of owning wide open space full of…

Read More

TIPS FOR SAFE HOLIDAY SHOPPING

The holiday season is upon us, and that means it's time to get your shopping on. While we all love getting great deals on Black…

Read More

CHECKING ACCOUNTS THAT WORK FOR YOU

When it comes to managing your money, there are a lot of different products, services, and support you can use. And while everyone's goals are…

Read More

THE BASICS OF BUYING LAND: 6 STEPS TO OWNERSHIP

A lot of people dream of staking claim to their own piece of land. The open space comes with all sorts of possibility, giving you…

Read More

SPOTTING FRAUDSTERS, SCAMMERS, AND IDENTITY THEVES ONLINE

Aside from the monetary losses caused by online scams, falling victim also has the potential to damage your credit score, hurt your chances of getting…

Read More

FINANCIAL FITNESS AND INSURANCE

Spring always brings a new wave of motivation! The great hibernation is almost over as people become more active. Maybe winter derailed your New Year’s…

Read More

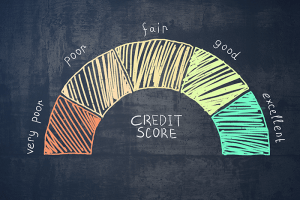

HOW TO UNDERSTAND YOUR CREDIT SCORE

Credit is one of the most important topics related to finances that will consistently affect a person’s financial situation. It is crucial to know what…

Read More

3 IMPORTANT QUESTIONS TO ANSWER BEFORE YOU BUY A HOUSE

These are just a few points to consider when you are thinking of purchasing a home. Before making your final decision, please consult a home…

Read More

MAKE YOUR CHECKING ACCOUNT WORK FOR YOU

A checking account is a checking account, right? WRONG! Checking accounts have become a “staple” of banking, but you have more options than ever before.…

Read More

BUYING A HOME IS EASY AS 1,2,3,4,5,6!

Buying your first home can be an overwhelming process if you don’t know where to start or what to expect. Following these steps will help…

Read More

USE YOUR HOME EQUITY TO YOUR ADVANTAGE

While some of us have put a spending freeze on our personal budgets, others are interested in making some home improvements or going back to…

Read More

BLESSED BY THE GIFT OF ADOPTION

Years ago, after Bill and Cathy were married, they felt passionate about growing their family, not only biologically but also to provide a forever family…

Read More

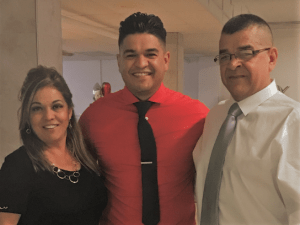

DIGNITY, RESPECT FOR ALL – A FAMILY LEGACY

Meet Mo. Mo works on the Marine team as a bilingual mortgage representative. He is an ITIN Certified Lender, which means he is uniquely qualified…

Read More